Understanding California Tenant Screening Laws is crucial for landlords and property managers who want to ensure they’re operating within the legal boundaries. This blog post delves into these laws, offering comprehensive insights on various aspects such as application screening fees, non-refundable fees, and the importance of issuing receipts.

We’ll also explore the impact of the new law on reusable tenant screenings – a key change that’s standardizing reusable tenant screening reports across California. Concerns about fraudulent or doctored documents will be addressed too.

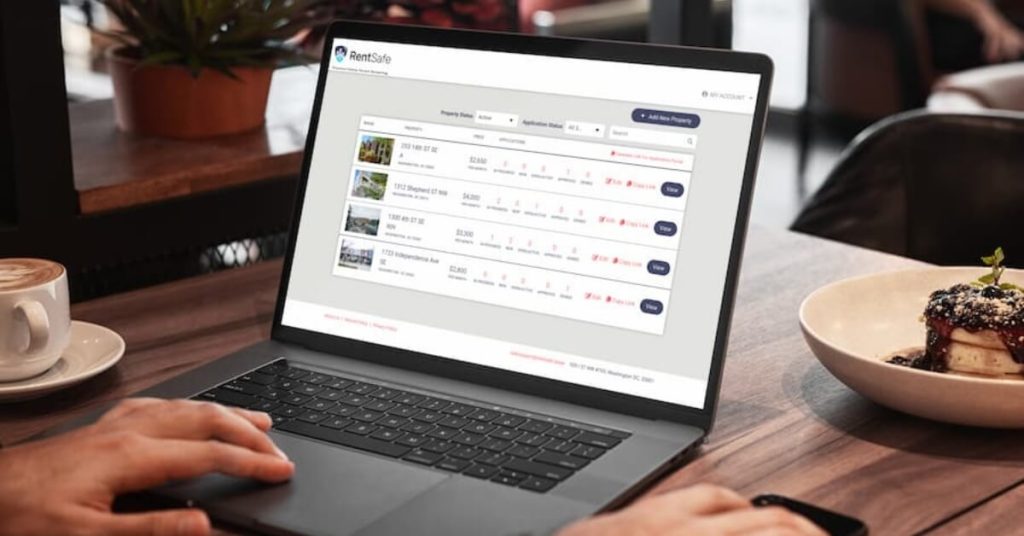

The role of online platforms in simplifying background checks for rentals listed will be discussed along with how small property owners can benefit from such services. Furthermore, we’ll touch upon protecting against discrimination allegations with objective criteria and other legal benefits derived from thorough tenant screenings under California Tenant Screening Laws.

Finally, guidelines regarding inclusion of cost screenings with applications fee and legality surrounding denial based on inaccessible credit reports are covered. The post concludes by introducing RentSafe – an efficient software solution designed to help navigate through complex tenant screening procedures compliantly.

Key Aspects of California Tenant Screening Laws

Application Fees and Costs

- California caps application screening fees per applicant

- Landlords can include actual costs of obtaining information (e.g., credit reports) in application fees

- No profit should be made from these charges

- Itemized receipts must be provided

- Unused portions of fees should be returned if requested

Reusable Tenant Screening Reports

- New law standardizes reusable tenant screening reports

- Renters can use secure reports for multiple properties within 30 days

- Landlords can choose whether to accept these reports

- Concerns exist about potential fraudulent or doctored documents

Legal Implications and Protections

- Thorough screenings protect against discrimination allegations

- Use objective criteria (e.g., credit history, income) rather than subjective factors

- Comply with Fair Housing Act and state regulations

- Maintain records to prove non-discriminatory decisions

Credit Report Access

- Landlords can legally deny tenancy if unable to access a frozen credit report

- Inform applicants about the need for credit report access

- Advise applicants to temporarily lift freezes if necessary

Online Platforms and Software Solutions

- RentSafe and similar platforms simplify the screening process

- Offer comprehensive background checks (criminal history, credit reports, eviction records)

- Ensure compliance with Fair Housing laws and state regulations

- Provide data security and user-friendly interfaces

- Particularly beneficial for small property owners

Best Practices

- Issue receipts for all financial transactions

- Use consistent standards for all applicants

- Avoid inquiries about protected characteristics (e.g., national origin, marital status)

- Demonstrate fair practices based on objective criteria

Important Note

Understanding California Tenant Screening Laws

As a landlord or property manager, understanding the regulations that govern tenant screening in California is crucial. These laws dictate how much you can charge for application fees and what checks are permissible. They also provide guidelines on non-refundable fees and receipt issuance.

The cap on application screening fee per applicant

In California, landlords cannot arbitrarily set their own prices for rental applications. In California, the state has set a cap on application screening fees to ensure fairness in the process and prevent potential tenants from being excluded due to high costs. This ensures fairness in the process and prevents potential tenants from being priced out of consideration.

Rules around non-refundable fees

Besides capping application fees, California tenant screening laws also regulate non-refundable charges during the tenant screening process. Landlords must clearly disclose any such costs upfront to avoid legal disputes later on.

Importance of issuing receipts

To maintain transparency throughout your dealings with prospective renters, it’s important to issue receipts whenever you collect money from them – whether it’s for rent payments or application processing expenses. This practice not only helps keep track of financial transactions but also protects both parties against potential misunderstandings down the line.

Navigating these complex laws might seem daunting at first glance but rest assured knowing there are resources available like RentSafe which simplifies this task by providing comprehensive histories and background checks while ensuring compliance at every step making it safer & effective solution for landlords & property managers alike.

Impact of Reusable Tenant Screening Reports Law

In a bid to make the rental application process more affordable, Gov. Gavin Newsom recently signed into law legislation that standardizes reusable tenant screening reports. This new law aims to save renters some cash by allowing them to use secure reusable reports when applying for multiple properties within a 30-day period.

Key features of the new law on reusable tenant screenings

- The landlord or property manager can decide whether to accept these reports, just in case of potential fraud concerns.

- Renters can save money by only needing one report, even if they’re applying for several properties.

- The law promotes transparency and efficiency in the rental application process.

This groundbreaking change aims to reduce barriers faced by prospective tenants during their housing search. However, it’s worth noting that while this initiative simplifies things for renters, landlords still have reservations about its implementation, mainly due to worries over fraudulent documents.

Concerns about fraudulent or doctored documents

Fraudulent activity is always a concern in transactions involving personal and financial information. With reusable tenant screening reports, landlords and property managers fear that applicants could potentially doctor these documents before submitting them with their applications. According to RentPrep, some states have already experienced issues with falsified records, leading many landlords to opt out of accepting such forms despite being legally allowed under state laws.

Online Platforms for Background Checks on Rentals

Landlords and property managers can now simplify their tenant screening process with online platforms RentSafe. RentSafe provides simple, comprehensive background checks for landlords in California and throughout the USA, and our automated compliance checks help to ensure compliance with California tenant screening laws, effectively insulating your property management company or rental business from legal liability.

Simplifying Background Checks with Online Platforms

Let RentSafe do the heavy lifting for you. We collect information, conduct thorough background checks, and provide detailed reports. These reports include credit history, criminal records, eviction history, and employment verification.

Save time and ensure consistency in your screening process. Choose a platform that guarantees compliance with tenant screening laws and regulations like the Fair Credit Reporting Act (FCRA).

Benefits for Small Property Owners

If you’re a small property owner without the resources or expertise for comprehensive screenings, these platforms are a game-changer. They provide reliable data quickly and at affordable rates.

- Ease: Streamlined process for even first-time landlords.

- Affordability: Pay per report, no upfront costs.

- Safety: Secure online transactions, no manual handling of sensitive information.

- Faster Decisions: Reduced turnaround time for quicker tenant decisions.

Leverage technology and simplify your role as a landlord or property manager. Online platforms offering rental background checks ensure adherence to legal requirements, making them an excellent resource during your tenant selection process.

Legal Implications of Tenant Screenings: More Than Just Suitability Assessment

Tenant screenings serve a dual purpose: finding good tenants and avoiding legal trouble. By sticking to objective criteria, you can protect yourself from discrimination allegations.

Protecting Against Discrimination Allegations with Objectivity

To avoid discrimination accusations, base decisions on objective factors like credit history, not subjective ones like race or religion. The California Department of Fair Employment and Housing (DFEH) provides clear guidelines on unlawful housing discrimination.

- Abstain from inquiring about national origin, wedlock standing, sexual direction, or incapacity.

- Evaluate all applicants using the same standards, such as income level, credit score, and references from previous landlords.

- Maintain records to prove your decisions were non-discriminatory.

Other Legal Benefits of Thorough Tenant Screenings

Thorough tenant screenings offer more than just protection against discrimination:

- Risk Mitigation: A comprehensive background check reduces the chances of future disputes or costly evictions.

- Evidence Collection: Documented proof of due diligence can be invaluable if legal issues arise later.

- Fair Housing Act Compliance: Proper screenings ensure compliance with federal laws, including the Fair Housing Act (FHA).

To sum up, while assessing suitability is important, understanding how tenant screenings protect against legal issues is crucial. Investing time and resources into thorough and compliant screenings is not just desirable, but necessary.

Including Cost Screenings With Application Fees Under Californian Law

The California Civil Code Section 1950.6 provides clear guidelines on this matter.

Guidelines regarding inclusion of cost screenings with applications fee

The law allows you to include the actual out-of-pocket costs associated with obtaining information about an applicant, such as credit reports, during the screening process within your application fee – but only if no profit is made from these charges.

- You can’t charge more than what it actually cost you to obtain this information,

- You must provide applicants with an itemized receipt showing these costs,

- If requested by the applicant, unused portions of this fee should be returned.

This approach not only ensures that landlords recover their expenses related to tenant screenings but also protects potential tenants from excessive application fees.

Legality surrounding denial based on inaccessible credit reports

Beyond costing considerations, there are other aspects of tenant screening that require careful attention for compliance under California law – particularly when dealing with credit report freezes. If a prospective renter has placed a freeze on their credit report and does not lift it long enough for you to access necessary information, then legally speaking; denying them tenancy is acceptable according to Federal Trade Commission guidelines .

To avoid any misunderstanding or potential disputes down the line:

- Inform applicants upfront about your need for access to their credit report as part of your standard rental application process,

- If they have frozen their report due current identity theft concerns , advise them accordingly so they can temporarily lift or “thaw” their freeze allowing sufficient time for review .

Navigating through complex laws like these requires diligent understanding and adherence which could be daunting at times especially if managing multiple properties . This where our software solution RentSafe comes into play making things simpler yet compliant every step along way ensuring both safety & effectiveness alike . Stay tuned till next section where we delve deeper into how RentSafe makes life easier for landlords & property managers across California .

RentSafe – Your Efficient and Compliant Software Solution for Tenant Screening

Being a landlord or property manager in California can be a real headache when it comes to tenant screening. Navigating the thicket of regulations that California landlords and property managers must adhere to can be an arduous task. But fear not, because RentSafe is here to save the day.

Why RentSafe is the Best Choice

- Background Checks Made Easy: RentSafe offers comprehensive background checks that cover criminal history, credit reports, eviction records, and more. No stone is left unturned.

- Compliance is Key: RentSafe is built to comply with Fair Housing laws and California-specific regulations. You’ll never have to worry about breaking the rules.

- Top-Notch Data Security: Your applicants’ personal data is safe and sound with RentSafe. We use advanced encryption technologies to keep everything secure.

- User-Friendly All the Way: Don’t worry if you’re not a tech whiz. RentSafe’s user-friendly interface makes it a breeze to navigate, even for the non-tech savvy.

Using RentSafe is like having a superhero by your side. It simplifies the complex world of Californian tenant screening laws, all while ensuring thoroughness and security. Whether you’re managing one unit or a whole empire, RentSafe saves you time and gives you peace of mind.

Remember, finding reliable renters who pay on time is important, but so is protecting yourself legally. With RentSafe, you can demonstrate fair practices based on objective criteria, avoiding any allegations of discriminatory leasing practices.

But wait, there’s more. Check out RentSafe’s comprehensive suite of features, including reusable tenant screenings. Now prospective tenants can submit their application once and share it with multiple landlords within 30 days. It’s a win-win situation.

When it comes to selecting who gets to live in your property, you want to be sure you’re staying compliant with current legislation. RentSafe has got your back.

Conclusion

Be aware of the cap on application screening fees per applicant, the rules around non-refundable fees, and the importance of issuing receipts.

The new law on reusable tenant screening reports has significant implications, including concerns about fraudulent or doctored documents.

Online platforms offering background checks for rentals can simplify the process for landlords, especially small property owners.

Thorough tenant screenings not only help assess suitability but also protect against discrimination allegations and provide other legal benefits.

Lastly, RentSafe offers an efficient and compliant software solution for tenant screening that can streamline the process. Have questions, reach out to our team today.

FAQs in Relation to California Tenant Screening Laws

Can my landlord inspect the property at any time in California?

No, a California law requires landlords to give reasonable notice before entering..

What are considered as red flags in screening a right tenant?

Poor credit history, inconsistent employment record, and negative references from previous landlords can be potential red flags.

What is the maximum allowable screening fee in California for 2024?

Are landlords required to accept reusable tenant screening reports in California?

No, California landlords are not required to accept reusable tenant screening reports. Landlords may opt into accepting the reusable background checks, but they are not required to do so under California Tenant Screening Law.

What is California's Assembly Bill No. 2559?

California’s Assembly Bill No. 2559 became effective January 1st, 2023 and allows for existing consumer background checks to function as reusable background checks for tenant screening. Landlords may opt into this program at their discretion, but are not required to do so.