Filling out a rental application if you’re living with parents can feel like stepping into uncharted territory. There is excitement in gaining independence but also uncertainty. What do you list for rental history when your current landlord is your mom? How do you prove you are financially ready if you have never paid rent before?

While it might seem like a logistical headache, you’re not alone and you’re not unprepared. In fact, this guide is built to help you stand out even without prior rental experience, and to avoid potential rental application red flags that could hurt your chances.

What You’ll Learn in This Guide

- How to fill out a rental application if you live with your parents

- What to list for rental history and monthly housing costs

- How to use personal and professional references effectively

- What role cosigners play and how they can strengthen your application

- Why emergency contacts and proof of income matter more than you think

Whether you are applying solo or with a cosigner, the key is to present yourself as responsible, communicative, and prepared. This guide will help you approach the rental process with clarity and confidence even if your last address still includes family dinners and laundry days.

Getting Started: What Landlords Look For

Filling out a rental application if living with parents might feel unfamiliar at first especially when you do not have previous rental experience to highlight. But the truth is landlords are not only interested in your rental history. They are also looking for signs that you are organized financially prepared and ready for the responsibilities of independent living.

That is where your rental application makes a big impression. Even without a prior lease the way you complete the form including your current address your contact details and employment information helps build trust and credibility with potential landlords.

In this section we will look at two things landlords typically evaluate first when reviewing a rental application from someone currently living with parents

- Why accurate contact details especially your current living situation matter for credibility

- What background checks involve and how to prepare when you do not have traditional rental history

With some preparation and transparency you can present yourself as a reliable tenant and take a confident first step toward living on your own.

Importance of Accurate Contact Details

When completing a rental application if living with parents, providing accurate and up-to-date contact details is essential. While it might seem like a small step, many applicants overlook this part, leading to unnecessary delays. Clearly listing your current residence (your parents’ home) and including their contact information offers transparency that helps landlords verify your living situation quickly.

This level of clarity reassures property managers and sets the tone for a smooth application process. If you’re applying through an online rental application, double-check that all fields are filled out correctly to avoid slowing things down. A strong first impression starts with the basics done right.

What Is Involved in a Background Check

A key part of any rental application if living with parents is the background check. Property managers typically review rental history to evaluate a tenant’s reliability, but this does not always mean you need a history of independent leases.

If you have been living at home, your parents or guardians can sometimes serve as informal references, especially if they have held financial responsibility and enforced consistent house rules. Understanding how landlords conduct background screening can help you prepare for this step with more confidence.

Landlords are often looking for signs of stability and responsibility. Even without traditional rental history, showing that you have followed payment expectations or contributed to household responsibilities can work in your favor.

Security deposits also factor into this equation. They act as a safety net for landlords, reassuring them that damages beyond normal wear and tear will be covered. Ultimately, every applicant has a different story. By embracing your situation and understanding how these checks work, you can stand out for all the right reasons, even if this is your first time stepping out on your own.

Key Takeaway:

Applying for a rental while living with your parents isn’t daunting. Remember to give accurate contact details, including your parents’, and don’t fret over the background check even if you haven’t rented before. Past landlords can include those responsible for current residences, like parents or guardians. Embrace your situation confidently; after all, many are in similar shoes.

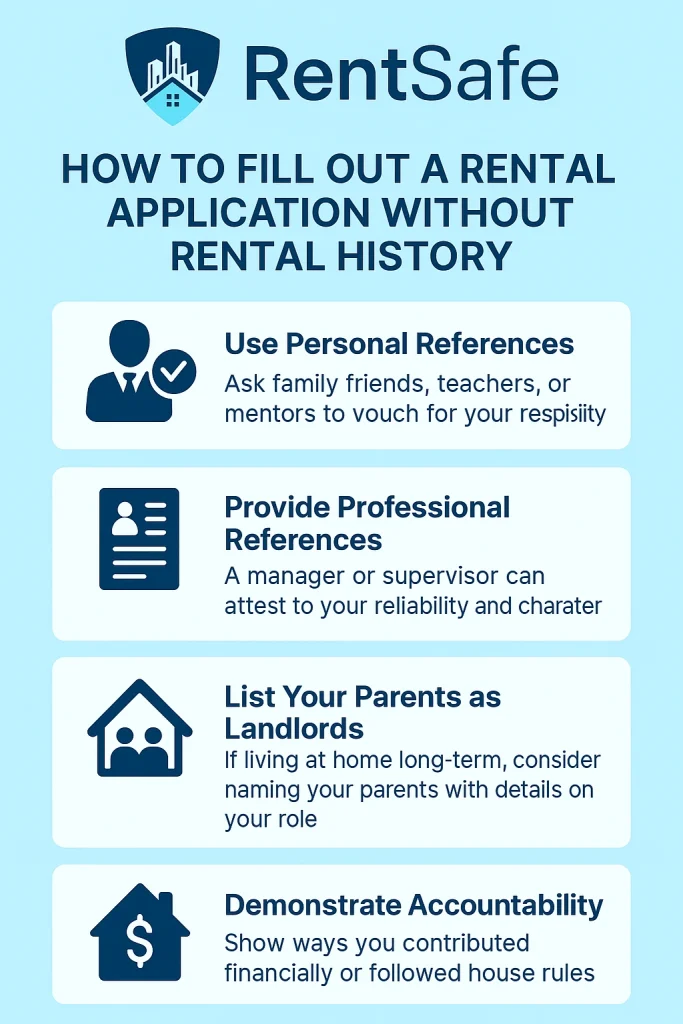

How to Fill Out a Rental Application Without Rental History

Filling out a rental application if living with parents can feel intimidating, especially when you don’t have traditional rental history to lean on. But don’t worry, there are other ways to demonstrate that you’re a responsible and reliable tenant. Landlords aren’t just looking for previous lease experience; they want reassurance that you’ll respect the property, pay rent on time, and communicate clearly. By highlighting strong personal and professional references, and even listing your parents in the right context, you can submit a confident, well-rounded application that stands out.

Using Personal References Effectively

When you don’t have prior landlords to list, personal references can help fill in the gap. These references should come from individuals who know you well and can vouch for your responsibility, reliability, and character. Think of teachers, mentors, coaches, or family friends. They can speak to how dependable you’ve been in other settings, such as school or work.

Make sure your references are informed and available, there’s nothing worse than a landlord calling a reference who isn’t expecting it. Also, include their full name, relationship to you, and accurate contact information.

Using trustworthy personal references shows landlords that, even without rental history, you’re proactive and serious about becoming a great tenant.

The Role of Professional References

Professional references are just as valuable (if not more so) than personal ones. A current or former employer, supervisor, or internship manager can speak to your work ethic, reliability, and ability to follow through on responsibilities. These are the same qualities landlords look for in tenants.

Landlords appreciate hearing that you show up on time, meet deadlines, and maintain professional communication. Even if you’ve never signed a lease, demonstrating your professionalism through a job or internship reference can carry significant weight.

Tip: Ask for permission before listing someone, and make sure they’re comfortable answering questions related to your responsibility and financial reliability.

Listing Your Parents as Landlords (When Appropriate)

If you’ve been living in your parents’ home for an extended time, they can serve as a landlord reference, especially if you’ve contributed financially or followed house rules similar to rental terms. Be transparent when listing them, and treat the reference with professionalism.

Provide clear contact details and note your role in the household. For example, mention if you helped pay bills, kept to a curfew, or maintained the property. This shows accountability and mimics the structure of a traditional rental agreement.

Keep in mind: While some landlords may discount references from immediate family, others will appreciate the transparency and responsibility you’ve shown by involving your parents formally in the process.

Key Takeaway:

If you’re applying for a rental while still living with your folks, don’t hesitate to use personal references. Your buddies, kinfolk, and educators can speak up about your dependability and personality. Even if you haven’t directly handled rent payments before, people like property managers from past residences or professional contacts such as bosses or coaches make great references. But hey, always make sure they’re okay with it first.

Strengthen Your Application with Financial Proof

By saving money during your time at home, you can demonstrate financial responsibility and give your application the boost it needs to move out of your parents’ house into a rental property. Showing that you’ve taken advantage of your time living at home by putting away some money is the key to strengthening your application.

Demonstrating Financial Responsibility

Your bank statements serve as a record of how well you manage money. Landlords like seeing consistent savings habits—it gives them confidence in your ability to handle rent payments responsibly. So if there were times when late rent payments might have happened but didn’t because you were staying with parents—that’s good news. Your saving habit is what counts here.

This is where an excellent track record comes in handy. By providing evidence such as regular deposits into a savings account or steady credit card repayments, landlords get reassured about your financial responsibility. Security deposit, which could be equivalent to several months’ worth of rent payment, would seem less daunting knowing these facts.

Importance of Stable Employment

Beyond demonstrating responsible use of personal finances, stable employment plays an essential role too. The most convincing way for young adults applying for their first rental unit is by providing pay stubs from their current employer along with contact details – this shows income stability.

You don’t want potential landlords doubting whether they’ll receive monthly rents on time or not – no one wants the hassle associated with late rents after all. Hence why proving stable employment status becomes so important: it sends across positive signals about reliable income stream and commitment towards responsibilities—a double win.

What Does Source of Income Mean on a Rental Application?

When landlords ask for your source of income on a rental application, they’re looking for proof that you have a reliable way to pay rent. It doesn’t just mean a full-time job-your income can come from multiple places, especially if you’re living with parents and still gaining financial independence.

Here are some common examples of acceptable income sources:

- Employment: Pay stubs from part-time, full-time, or freelance work

- Parental support: If your parents provide financial assistance, that counts

- Savings: A strong bank balance with consistent deposits

- Scholarships or grants: Financial aid for students

- Government benefits: Disability income, child support, or housing assistance

Landlords want to feel confident you can meet monthly payments. So, even if you haven’t rented before, showing that you have a stable and verifiable income source builds trust. Include documentation, like recent pay stubs, bank statements, or award letters-whatever best supports your situation.

Being honest and thorough here is key. It shows responsibility and gives landlords peace of mind, even if your rental history is limited.

Using a Cosigner or Guarantor to Qualify for a Rental

If you are filling out a rental application while living with parents and do not have a rental history, you are not alone. Many first-time renters are in the same situation. One of the most effective ways to strengthen your rental application is by using a cosigner or guarantor, often a parent or close family member.

This person provides additional financial assurance to the landlord by agreeing to take responsibility if you are unable to make rent payments. It can significantly improve your chances of getting approved, especially when your rental history is limited or nonexistent. If you’re unsure how this process works, it helps to understand how to add a cosigner to a lease and what responsibilities they assume.

Before moving forward, it is important to understand how cosigners and guarantors differ, when your parents can legally support your application, and how you can still show you are ready to take on the responsibilities of renting your own place.

Let’s explore how to approach a rental application if living with parents and how a cosigner or guarantor can help you qualify with confidence.

The Role of Guarantors in Rental Applications

Similar to cosigners, guarantors also bear financial risk but their responsibilities are slightly different. Many landlords require a guarantor when young adults apply for rentals without steady income proof or credit history.

Your potential landlord might double check the maximum occupancy limit as it affects whether they will accept a cosigned agreement. The number varies based on local laws and size of the rental unit, so always ensure that adding an extra name won’t violate these limits.

When a Parent Can Rent an Apartment for You

If you’re completing a rental application while living with parents, you might wonder whether your mom or dad can just rent the apartment for you. The answer is sometimes, yes. But it depends on how the lease is structured and the landlord’s policies.

In many cases, a parent can rent an apartment on your behalf by signing the lease themselves. This means they are the legal tenant, and you are simply residing there. This arrangement is common for college students or young adults who aren’t yet financially independent. However, landlords may have restrictions on who is allowed to live in the unit, especially if your name is not on the lease.

A more common solution is for your parent to cosign or act as a guarantor on your rental application. This allows you to be the primary tenant while giving landlords additional financial security through your parent’s income and credit. It also shows that you are transitioning toward financial independence, something landlords often value.

Keep in mind: if your parent is renting the unit in their name only, you won’t be building rental history in your own name. That’s a missed opportunity if you’re planning for long-term independence. So, if your goal is to eventually rent solo, it’s usually better to have your name on the lease with a parent supporting you as a cosigner.

Ultimately, whether your parent signs the lease or just supports your application, transparency with the landlord is key. Make sure you understand the lease terms and how your role as a resident is defined before moving in.

Demonstrating Your Responsibility as Tenant

To ease concerns about late rent payments or possible damages beyond security deposit coverage, be proactive about demonstrating yourself as responsible tenant through other means too.

- Showcase any part-time jobs held during school years indicating commitment and reliability even though those weren’t full-time positions

- Paying off student loans consistently shows good track record in managing finances responsibly

Double Checking Details Before Submission

Including both applicant’s and co-signer’s information accurately becomes paramount now more than ever since incomplete applications could delay approval process or worse, result in denial.

Make sure to provide proof of income and employment for both parties. It’s a good idea to include account statements from your cosigner showing their ability to pay rent if necessary.

A Final Thought

Cosigners can be the key that unlocks the door to your first rental unit. But remember, this is more than just adding an extra name on your application; it’s about creating a safety net for landlords while demonstrating you’re responsible enough not just living independently but also meeting financial obligations timely.

Key Takeaway:

Applying for a rental while living with parents? A cosigner can really boost your application. Often, this is where your folks come in – they promise to cover the rent if you stumble. Impress landlords by showing them how dependable you are: maybe through part-time work or steady student loan payments. Don’t forget to include all financial details and contact info for both of you in the application. It could make all the difference.

Filling Out Additional Application Information

Applying for a rental can be intimidating, particularly if you have been residing with your folks. You might wonder how to make your application stand out without previous landlords’ references or rental history. But fret not. The additional information section in the rental application is where you get to shine.

This space lets potential property managers understand more about who you are and why they should consider you as their next responsible tenant. Here, we’ll help guide what kind of details could be helpful.

Pet Information

If you’re moving into an apartment complex that allows pets, it’s crucial to provide detailed pet information. This helps landlords determine if your furry friend aligns with their policies or occupancy limit.

Including specifics such as breed size and temperament demonstrates responsibility towards maintaining harmony within the community and respecting the maximum occupancy limit set by the landlord. PetFinder’s resource gives good insight into this topic.

The Reason For Moving

Your reason for moving tells a lot about your current living situation and future plans which affects how long you may stay at the prospective property—a factor many landlords pay attention to while screening applicants.

If relocating because of job changes or seeking more independence from living under parents’ roof, ensure these reasons resonate well with financial responsibility—another aspect that strengthens applications even further.

Remember: Keep everything honest yet positive. It’s okay to list your parents’ address as the current living place or even have them act as guarantors if needed. Make sure to double check all information before submission, and feel free to ask property managers any questions you might have about their rental agreement.

Monthly Housing Payment if Living with Parents

Many rental applications ask for your current monthly housing payment-but what if you’re living at home and not paying formal rent?

If you live with your parents rent-free or contribute irregularly to household expenses, here’s how to handle that field:

- Be transparent: If you don’t make formal rent payments, simply write “N/A” or “Living with parents, no monthly rent” in the field.

- If contributing financially: If you help with utilities, groceries, or other household expenses, estimate your average monthly contribution and include a short explanation, such as “$250 toward household expenses.”

- Don’t inflate numbers: Avoid making it seem like you’re paying rent if you’re not. Landlords value honesty over inflated figures that don’t align with your documentation.

Being upfront helps property managers understand your financial obligations and assess how prepared you are for independent rent payments. When completing a rental application if living with parents, clarity and consistency are key.

Type of Residence (When Living with Parents)

Another common question on rental applications is your “type of residence.” If you’re still living at home, this section might feel a bit awkward, but it’s easy to handle with the right approach.

Here’s what to consider when filling it out:

- Select or write “Family Home” or “Living with Parents” if that’s an option.

- If asked for more details, specify “Single-family residence with parents” or “Owner-occupied residence (family-owned).”

- Keep it consistent with the address you list elsewhere on the application, this helps prevent confusion during background or reference checks.

This section simply helps landlords understand your living situation, it’s important to highlight that not having your own lease history won’t disqualify you. Just like with your rental application if living with parents, focus on being honest and accurate across all fields.

Key Takeaway:

Finding a rental while still at your folks’ place isn’t as hard as you think. Use that extra info box on the application to your advantage – tell them about any pets and why you’re ready for a change of scenery. Remember, honesty wins but always keep it upbeat. It’s totally fine to list your parents’ address or even have them vouch for you if needed.

Emergency Contact Section Explained

The importance of including emergency contact information on your rental application cannot be overstated. Despite its seemingly minor significance, emergency contact information on a rental application is of immense importance to landlords and property managers. Here’s why.

Why is Emergency Contact Info Necessary?

Your potential landlord needs this info just in case an unexpected situation arises where they need to get in touch with someone close to you urgently. This could range from serious incidents such as health emergencies or accidents within the rental unit, all the way down to something as simple as forgetting your keys inside.

In fact, many apartment complexes have rules that mandate tenants provide emergency contacts for their safety protocols.

Making Sure You Choose The Right Emergency Contacts

Selecting appropriate people for your emergency contact list requires careful consideration. While family members are often chosen due to their immediate relation and concern for you, don’t overlook others who may also be good choices.

If you’re living far away from family or if they aren’t available round-the-clock because of work schedules or other reasons, consider adding local friends or colleagues instead. Even past employers, teachers, or mentors can serve well in this role too given that they’d likely want what’s best for you during an unforeseen circumstance at home.

Filling Out Your Form Accurately

While filling out these details on your application form, remember accuracy is key. Don’t simply jot down names without verifying phone numbers first – imagine how problematic it would be if there was indeed an urgent need only to find out later that the number provided isn’t valid anymore.

To avoid any hiccups, double-check your emergency contacts’ phone numbers and get their consent before listing them on your application. Alert those you list as emergency contacts that they may be contacted by property managers in the event of an urgent situation.

Privacy Considerations

Last but not least, make sure you respect the privacy of those you list as emergency contacts. Your potential landlord should only use these contact details for legitimate emergencies or matters directly related to your tenancy.

So, wrapping it up, investing the time to correctly fill out

Key Takeaway:

Don’t underestimate the importance of accurate emergency contact information on your rental application. Choose contacts who are reliable and accessible, not just family members. Double-check their details for accuracy and get consent before listing them. Remember, this info is vital for potential landlords to handle unexpected situations swiftly and responsibly.

Your Rights as a First-Time Renter

So, you’re ready to fly the nest and find your own space. It’s an exciting time. But let’s be real, it can also feel a bit daunting. Before signing their lease agreement, every first-time renter should be aware of their rights as a tenant – an important factor to consider when renting for the first time.

The world of rental agreements may seem like a foreign language at first glance. That’s why we’ve put together this primer on renters’ rights that every first-time renter should know before signing their lease agreement.

Your Right to Privacy

In most states across the U.S., landlords must give notice before entering your rented property unless there’s an emergency situation such as fire or water leak. Most states require between 24 hours and two days notice for landlords to enter a tenant’s property, unless there is an emergency.

Rent Increase Rules

A common worry among tenants is unexpected rent hikes eating into their budgets. However, most states have laws in place that require landlords provide adequate notice before increasing rent — usually between 30 and 60 days depending on local regulations.

Maintenance Responsibilities

No one wants to live in a poorly maintained home with plumbing issues or broken appliances. Generally speaking, landlords are responsible for keeping properties habitable under implied warranty of habitability laws. If they fail in these duties, you could potentially withhold part or all of your rent until repairs are made.

Remember: Knowledge is power. So do yourself a favor and make sure you’re clued up about what responsibilities fall on whom.

Keep exploring our guide here at RentSafe to learn more about your rights as a tenant and other important aspects of renting. It’s our mission to help you feel confident, secure, and empowered in your journey from living with parents to becoming an independent renter.

Can My Mom or Dad Rent an Apartment for Me?

Yes, in many cases, a parent can rent an apartment for you, but it depends on how the lease is structured and the policies of the property management company or landlord.

Here are the most common ways this works:

- They rent it in their own name: Your parent signs the lease as the primary tenant. This means they hold full legal and financial responsibility, even if you’re the one living in the unit.

- They cosign the lease: You’re listed as the tenant, and your parent signs as a cosigner or guarantor. They’re only responsible for rent or damages if you fail to uphold the lease.

- Joint tenancy: In some cases, both you and your parent may be listed on the lease as co-tenants. This can help if you’re still building credit or lack income stability.

If the landlord requires proof of income and you don’t have a full-time job yet, having your parent involved (especially as a cosigner) can strengthen your application significantly.

Before moving forward, make sure to:

- Be transparent with the landlord about your living and financial situation.

- Understand your own legal responsibilities, especially if you’re also signing the lease.

- Confirm occupancy limits and lease policies to ensure a parent signing won’t raise issues.

This setup is common for college students, first-time renters, and anyone transitioning into independent living. Just remember, even if your parent signs the lease, it’s your job to prove you’re ready to be a reliable, respectful tenant.

Key Takeaway:

Stepping out to rent for the first time can be thrilling, but it’s crucial to know your rights. From privacy laws that protect you from unexpected landlord visits, regulations on rent increases, to understanding maintenance responsibilities – knowing these keeps surprises at bay. So gear up with knowledge and feel confident as you transition from living with parents to being an independent tenant.

Ready to Step Into Your First Place?

Leaving the nest can feel overwhelming, but once you understand the rental application process, you’ll find the path to independence much clearer. Applying for a rental while living with parents is more common than you might think, and with the right preparation, it can actually work to your advantage.

By offering accurate contact information, strong personal or professional references, and financial documentation, you’re not just completing a form, you’re showing landlords that you’re ready to be a responsible tenant. Having your paperwork in order (including income verification, references, and other essential landlord documents) helps build trust from the very start.

The bottom line: this step marks the beginning of something big. And you’re ready.

Start Screening Tenants Faster With RentSafe

If you’re a landlord or property manager looking to streamline the rental process, RentSafe is here to help. Built by property managers for property managers, RentSafe simplifies tenant screening with a platform designed to move as fast as your leasing team.

Create a free account in seconds – no credentialing required – at RentSafe Property Manager Registration

Have questions or want to talk to our team about how RentSafe can support your goals? Contact us anytime – we’re happy to help!

Common Questions About Renting While Living with Parents

What should I put for rental history if I've been living with my parents?

If you haven’t rented before, you can list your parents’ home as your current residence. Be sure to include the address and how long you’ve lived there. You can also list your parents as references if they’ve been responsible for housing you. This helps landlords understand your living history even if it doesn’t include formal lease agreements.

What's a good reason for moving out of my parents' house for a rental application?

Common reasons include starting a new job, pursuing independence, attending school, or relocating for better opportunities. Keep the reason simple and honest-landlords just want to understand your motivation and whether it supports your long-term stability as a tenant.

Can my mom or dad rent or lease an apartment for me?

Yes, a parent can co-sign or lease an apartment on your behalf, depending on the landlord’s policies. In many cases, a parent acting as a cosigner can strengthen your application if you lack income or rental history. Just make sure all parties understand their responsibilities before signing.

Can I use my parents as a rental reference?

Yes, especially if you’ve been living with them for an extended period. However, landlords may also appreciate non-family references like teachers, employers, or coaches who can speak to your reliability and behavior.

Should I pay rent or live with my parents to save money?

Living at home can be a smart way to save for a future rental. That said, paying rent-even to your parents-can help establish financial habits and provide documentation of your reliability when you apply for your own place.

Can my mom cosign for an apartment?

Definitely. A parent cosigning adds credibility to your application by backing you financially. Just make sure your cosigner meets the landlord’s income and credit requirements and understands their legal responsibility.

What does 'source of income' mean on a rental application?

It refers to how you’ll pay rent-such as through a job, financial aid, savings, or family support. Be transparent and include documentation like pay stubs, bank statements, or a letter from whoever is providing financial assistance.